April 14, 2022

Source: HMDA data. Some census tracts have been excluded because the Census Bureau does not provide demographic data. Saurabh Datar/wbur

Second in a series

Part one here

Homeownership is the primary way most Americans build wealth. And for most people, buying a home doesn’t happen without a mortgage loan. Altogether, home loans amount to billions of dollars flowing into Boston every year, but this infusion doesn’t reach all parts of the city equally.

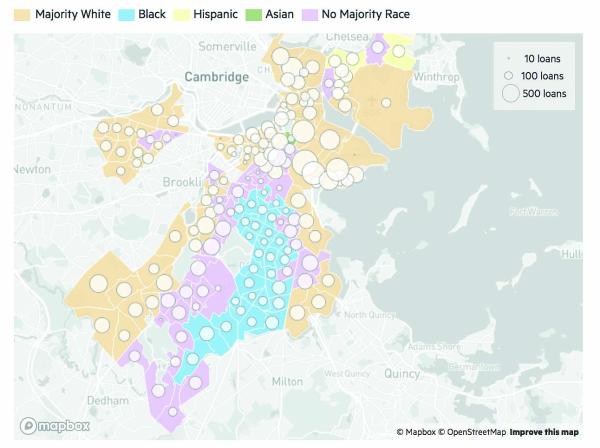

A WBUR analysis has found that lenders make a significant majority of home loans in predominantly white areas in Boston. In a city as segregated as Boston, looking at the geography of where mortgage lending is happening — or not — reveals which neighborhoods continue to lose out on investments that others are getting.

“Unfortunately, it follows a pattern that we have seen in the past where certain neighborhoods in Boston, in a sense, get a much bigger piece of the pie,” said James Jennings, a professor emeritus at Tufts University and an expert on race, urban planning and economic development.

WBUR analyzed loan data for home purchases in Boston from 2015 through 2020. That’s 37,465 loans, totaling $24.1 billion. Here’s a snapshot of what we found:

• About 63 percent of home loans went to majority-white census tracts in Boston, while about 11 percent went to majority-Black census tracts.

• South Boston received more home loans than all of the city’s majority-Black census tracts combined.

• In most neighborhoods where people of color are the majority, white homebuyers still received the largest share of mortgage loans.

• Some lenders issued more than 20 times more loans for properties in white areas compared to Black areas.

Buying a home can create financial security, ensure housing stability, and leave wealth for future generations — which can have an impact on a family and on a community. And economic development experts say home lending can influence how neighborhoods are shaped and transformed.

Many factors contribute to differences in mortgage lending, including turnover in the housing market, construction of new housing, property values, and long-standing economic disparities. But the data reveal how access to homeownership is not equal throughout Boston.

“These disparities in lending continue to drive racial disparities in wealth, and racial disparities in wealth drive disparities in so many other dimensions of life: health, education, employment opportunities, well-being, etc.,” said Justin Steil, an associate professor of law and urban planning at MIT, who studies racial equity in housing.

The areas in Boston with a lot of mortgage lending have also experienced tremendous development, including high-end housing, in recent years.

WBUR’s analysis found that significantly more new housing units were added in majority-white areas than other parts of the city. City data show that two-thirds of certificates of occupancy for new units were issued in majority-white areas, which account for less than half of the city. Fewer than 5 percent were issued in majority-Black areas, which constitute 17 percent of the city. About 25 percent of census tracts in Boston have no clear racial or ethnic majority.

Along Broadway, which cuts through the center of South Boston, there are juice bars, trendy restaurants, and niche retail shops to pamper pets, plants and people. There are also construction sites and shiny new buildings. In front of one building, a sign reads, “New luxury condos. Now accepting reservations,” in art deco-style font. Down the street, two other luxury condo developments promise even more high-priced dwellings, retail space and other amenities

“There’s a certain kind of almost boutique atmosphere to it,” Jennings said during a walk through the neighborhood.

Strikingly, South Boston, which is 77 percent white, received more home loans — 4,689 — than all of the city’s majority-Black census tracts combined.

Jennings would like to see the same kind of injection of money and new development that South Boston has received directed to other neighborhoods, where most people of color live. He said this would give those residents more opportunities to enjoy the benefits of homeownership.

“Owning a home — and having access to resources to own that home and also to fix it up — means that people have equity to start businesses. People have equity to pay for education costs of their children,” he said. “People have equity to transfer wealth from one generation to the next generation.”

Mortgage lending can also help bring other types of lending into a neighborhood, according to Brett Theodos, a senior fellow at the Urban Institute who studies how capital moves in cities across the country. “Home lending is associated with other lending to a very high degree,” he said, such as for small businesses and commercial developments like grocery stores.

In Boston, homes are expensive and in short supply. The highly competitive market makes it even more challenging for historically disadvantaged groups to buy homes. For some Black residents, that has meant leaving the city to make their dream of owning a home come true.

Kellie and Jha D. Amazi search online listings looking for a house in Boston.

“I literally had no choice financially,” said former Boston resident Sabrina Xavier, who ended up buying a single-family house in Brockton last summer. She said she’s happy to have her own home, but there are downsides. It’s less walkable, and there are fewer food options and other amenities than where she has lived in Brighton, Dorchester, and Roxbury. Xavier now has to commute over an hour by car and train to get to her public health job in Boston.

She purchased her home with help from the state’s ONE Mortgage, which offers a low down payment and other benefits for low- and moderate-income homebuyers. But Xavier said the amount she was pre-approved for just wasn’t enough to compete in Boston’s housing market.

As the youngest of eight, Xavier always wanted to have her own property. That way she could build equity that might help her and future generations of her family. “It felt horrible that I grew up in the city that I couldn’t even afford to live in.”

“Hopefully things change in Boston where, you know, we’re not being pushed out,” Xavier said. “I feel like Black and brown folks are being pushed out of Boston because it’s so expensive, and they’re going to other suburbs where there’s less resources because that’s all they could afford.”

In fact, according to the 2020 census, Boston’s Black population has dropped compared to 2010. Hyde Park, Mattapan, Roxbury, and Dorchester — where 75 percent of Boston’s Black population lives — each saw declines in the percent of Black residents.

The data WBUR analyzed showed that in most of these neighborhoods, white borrowers received the largest share of home loans. More than half of the loans approved in Dorchester went to white borrowers, even though white people made up about 22 percent of the population.

Amid these trends, some Black homebuyers are concerned about gentrification. There’s Jha D. Amazi, who is determined to find a multifamily house in Dorchester, Roxbury, Mattapan or Hyde Park. “I’m from here, and I’ve always been committed to pouring back into the place that helped raise me,” she said.

The 36-year-old and her wife spend their evenings on various real estate apps and have looked at dozens of houses. The process has been a mix of excitement and frustration that has constantly ended with her getting outbid. Amazi said she’s considering leaving the state altogether if things don’t pan out in Boston.

“We’ll have to figure out how much longer we have in us before we throw in the towel,” she said. “And if we have to look outside of Boston, then that’s a bridge we’ll cross when we get there. But it is kind of Boston or bust.”

Citywide, when looking at loans given to majority-white and majority-Black areas, white areas received nearly five times more loans than Black areas.

A closer look at specific financial institutions shows some with an even wider disparity. For example, large national lenders like JP Morgan Chase and Wells Fargo, as well as regional banks like People’s United and Webster Bank, made more than 20 times more loans in white-majority areas compared to Black-majority parts of Boston.

When asked for comment on WBUR’s analysis, many lenders pointed out that they fund various programs to help first-time homebuyers, increase accessibility to mortgage loans, and create affordable housing.

“Massachusetts banks are working to ensure that all qualified homebuyers have access to fair and affordable mortgage products,”

Massachusetts Bankers Association CEO Kathleen Murphy said in a statement. “Our members continue to innovate, creating programs and partnering with non-profit organizations and local governments to make the homeownership dream a reality.”

Connecticut-based People’s United made 27 times more loans in majority-white areas than majority-Black areas – the largest disparity of any bank. The bank said it regularly conducts its own lending analysis and has found “no significant statistical difference” between its lending and its peers’ lending to Black residents in Boston from 2018-2020.

“Our underwriting requirements are applied equally to all mortgage applicants regardless of race, ethnicity, location, or any other prohibited basis, and applicants must meet the bank’s underwriting requirements which include factors such as income, credit scores, and debt-to-income ratios,” People’s United spokesman Steven Bodakowski said in a statement.

JP Morgan Chase made 25 times more loans in majority-white areas than majority-Black areas. The bank said that in 2020, it made a $30 billion commitment to improving racial equity and is expanding its presence in the city, including a new branch now in Mattapan.

It did not open its first Boston location until late 2018, although federal data show that the bank made loans in the city before that time.

“We expect to serve more Bostonians with their home buying needs in the months and years ahead,” a spokeswoman said in a statement.

Housing advocate Symone Crawford, the executive director of the Massachusetts Affordable Housing Alliance, said more financial institutions should offer products like the state’s ONE Mortgage program, “so people of color can actually be able to purchase” homes.

Some lenders in WBUR’s analysis, including People’s United and Webster Bank, do offer that mortgage product, but many do not. Experts said that’s at least one of many potential solutions lenders could put their resources toward.

“We have the capacity to help Black and brown people into the housing market,” Crawford said. “And these lenders need to seriously put their money where their mouth is.”

This article was originally aired and published by WBUR 90.9FM on March 31. The Reporter and WBUR share content through a media partnership.